What are the 2 most common methods of estimating uncollectible receivables?

Let’s dive deeper into these methods.

The percentage of sales method is a simple approach that bases the bad debt expense on a percentage of credit sales. This percentage is usually determined by historical data or industry averages. For example, if you typically experience a 2% bad debt rate, you would estimate 2% of your credit sales as uncollectible. This method is easy to use, but it might not be accurate if your sales patterns change significantly.

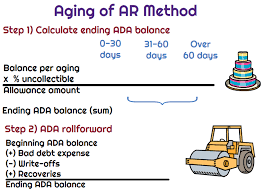

The accounts receivable aging method, on the other hand, focuses on the age of outstanding receivables. It assumes that older receivables are more likely to become uncollectible. This method involves categorizing receivables into different age groups (e.g., 30 days past due, 60 days past due, etc.). Each age group is then assigned a different percentage representing the likelihood of collection. This method is more detailed and accurate than the percentage of sales method, but it requires more effort to implement.

Both methods have their strengths and weaknesses. The percentage of sales method is simple and quick, but less accurate if sales fluctuate. The accounts receivable aging method is more accurate but requires more effort and data. The choice of method depends on the specific circumstances of your business and the level of detail you need.

What are the two methods of accounting for uncollectible accounts are a percentage of sales and B percentage of receivables?

The percentage of sales method focuses on the income statement and the relationship between uncollectible accounts and sales. This method estimates the bad debt expense based on a percentage of the company’s total credit sales. Think of it like this: if historically, a certain percentage of your sales haven’t resulted in payment, you can use that percentage to estimate how much you might not collect this year.

The percentage of receivables method, on the other hand, focuses on the balance sheet and the relationship between the allowance for uncollectible accounts and accounts receivable. This method estimates the bad debt expense based on a percentage of the company’s outstanding receivables. This method is considered more accurate because it directly relates the allowance for uncollectible accounts to the actual outstanding balance.

To better understand this, imagine you have a pile of unpaid invoices. The percentage of receivables method says “Let’s look at how much of this pile is likely to go unpaid and set aside a reserve for that”.

Here’s the key difference:

Percentage of sales method: Focuses on how much you sold on credit and estimates how much of those sales will be uncollectible.

Percentage of receivables method: Focuses on how much is currently owed to you and estimates how much of that is unlikely to be collected.

Both methods have their pros and cons. The percentage of sales method is simpler to apply, but it may not be as accurate as the percentage of receivables method. The percentage of receivables method is more complex, but it is generally considered to be a more accurate reflection of the company’s actual uncollectible accounts.

What are the two methods of accounting for receivables?

Let’s dive deeper into how these methods work:

The Allowance Method:

How it Works: The allowance method is the generally accepted accounting principle (GAAP) method. This method involves setting up an allowance for doubtful accounts account. This account represents an estimated amount of money that a business expects it won’t collect from its customers. To determine this estimate, businesses often use historical data, industry averages, and their own credit policies.

Benefits:

Matching Principle: The allowance method helps businesses follow the matching principle, which states that expenses should be recognized in the same period as the revenue they generate. Since the allowance is established when the sale is made, the bad debt expense is matched with the revenue generated from the sale.

More Accurate Financial Reporting: The allowance method results in more accurate financial reporting because it reflects the estimated amount of bad debt right when the sale is made.

Example: Suppose a business sells $100,000 worth of goods on credit. They estimate that 2% of their credit sales will be uncollectible. Using the allowance method, they would set up an allowance for doubtful accounts of $2,000 (2% of $100,000). When a customer defaults on their payment, the business would write off the specific account receivable, but the overall allowance for doubtful accounts would remain relatively stable.

The Direct Write-Off Method:

How it Works: The direct write-off method is a simpler method than the allowance method. When a customer defaults on their payment, the business simply removes the specific account receivable from its balance sheet. This means they recognize the bad debt expense only when they know for sure that a customer won’t pay.

Benefits:

Simplicity: The direct write-off method is easier to understand and implement compared to the allowance method.

Drawbacks:

Violates the Matching Principle: Since the expense isn’t recognized until a customer defaults, the direct write-off method doesn’t align with the matching principle. This can make it difficult to accurately assess the company’s financial performance.

Inaccurate Financial Reporting: The direct write-off method can create an inaccurate representation of a company’s financial performance because it doesn’t account for potential bad debts until they actually occur.

Example: Using the same example as above, if a customer defaults on a $1,000 payment, the business would directly write off the $1,000 from their accounts receivable balance and recognize the $1,000 as bad debt expense on the income statement.

In summary:

While the direct write-off method is simpler, it isn’t as accurate and violates GAAP principles. The allowance method, while more complex, provides a more realistic and accurate picture of a business’s financial health by recognizing bad debt expense when the sale is made.

What are the two methods for accounting for bad debt expense?

Let’s start with the direct write-off method. This method is pretty straightforward. When a specific account becomes uncollectible, it’s immediately written off as an expense. Think of it like recognizing the loss as it happens.

The allowance method, on the other hand, takes a more proactive approach. Instead of waiting for an account to become uncollectible, it sets up an allowance for doubtful accounts. This allowance acts like a reserve for potential bad debts, and it’s adjusted regularly to reflect the latest estimates.

Now, let’s delve deeper into the allowance method. This method is preferred by many because it provides a more accurate picture of the company’s financial health. It’s about recognizing potential bad debts before they actually occur, which helps to smooth out the income statement.

There are two common ways to estimate the allowance: the percentage of sales method and the aging of accounts receivable method.

* The percentage of sales method calculates the allowance based on a percentage of credit sales. It’s a simpler approach but may not be as accurate as the aging method.

* The aging of accounts receivable method looks at the outstanding receivables and classifies them based on their age. The older the receivable, the higher the risk of it becoming uncollectible. This method usually provides a more precise estimate of the allowance.

The choice between the direct write-off method and the allowance method depends on the company’s specific circumstances and accounting standards. However, the allowance method is generally preferred due to its more accurate portrayal of financial health.

What are the two methods of uncollectible accounts?

There are two main approaches: the direct write-off method and the allowance method. Let’s dive a bit deeper into each.

The Direct Write-Off Method

Think of this method like a “clean slate” approach. When a customer’s account is deemed uncollectible, you simply remove it from your books. You write it off as an expense for the period in which the determination is made.

This method is simple and straightforward, but it has a big drawback: it doesn’t accurately reflect the true cost of bad debts during any given period. Imagine you have a bad debt in December. Using the direct write-off method, you wouldn’t reflect that expense until December, even if the debt originated earlier in the year.

The Allowance Method

The allowance method takes a more proactive approach. It’s designed to match the expense of bad debts to the period in which the related revenue was generated. Here’s how it works:

Estimate bad debts: You make an estimate of the total amount of uncollectible accounts you expect to have. This estimation can be based on past experience, industry averages, or even a percentage of credit sales.

Create an allowance account: You establish a contra-asset account called the Allowance for Doubtful Accounts. This account is used to reduce the balance of your accounts receivable.

Write off specific debts: When an account is deemed uncollectible, you debit the Allowance for Doubtful Accounts and credit Accounts Receivable. This effectively removes the bad debt from your books.

Why the allowance method is often preferred:

More accurate accounting: By spreading the cost of bad debts over the periods when the revenue was earned, you get a more accurate picture of your company’s financial performance.

Better financial reporting: This method results in more reliable financial statements, which can be helpful for investors, lenders, and other stakeholders.

Tax benefits: The allowance method is usually preferred for tax purposes, since it allows you to deduct the expense of bad debts as they’re estimated, rather than only when they’re actually written off.

The allowance method might seem more complex at first, but it’s generally considered a more sound and transparent way to manage uncollectible accounts in the long run.

What are the two types of receivables?

Accounts receivable are the amounts owed to a company by its customers for goods or services that have already been delivered or rendered but not yet paid for. They typically arise from credit sales, which are transactions where the customer is allowed to pay for the goods or services at a later date.

Notes receivable, on the other hand, are written promises to pay a specific sum of money on a certain date. These are usually accompanied by an interest rate, which is the cost of borrowing the money.

Think of it this way: accounts receivable are like informal “I owe you” notes, while notes receivable are more formal, written agreements that outline the terms of repayment.

Let’s break down the differences a bit further:

Accounts Receivable:

Informal: No written agreement, usually based on an invoice.

Short-term: Typically due within 30 to 60 days.

Interest: Usually no interest is charged.

Notes Receivable:

Formal: A written agreement outlining terms of repayment.

Short-term or long-term: Can be due in a few weeks or even years.

Interest: Usually includes an interest rate.

Understanding the differences between accounts receivable and notes receivable is important for businesses because it helps them manage their cash flow and make informed decisions about extending credit to customers.

What are the two methods of accounting for?

Cash accounting is simple. It tracks revenue when you actually receive the money and records expenses when you pay them out. Think of it like your personal checking account – you see the money coming in and going out. This method is straightforward, especially for smaller businesses or individuals who might not have complex transactions.

Accrual accounting is a bit more nuanced. It tracks revenue when it’s earned, even if you haven’t received the payment yet. Similarly, expenses are recorded when they are incurred, even if you haven’t paid for them yet. For example, if you sell a product on credit, accrual accounting would recognize the revenue even though you haven’t received the payment. Conversely, if you receive a bill for utilities, accrual accounting would record the expense even if you haven’t yet paid it.

Think of it this way: cash accounting is like a snapshot of your financial position at a specific point in time, while accrual accounting is a movie of your financial activity over time.

So which method should you use? That depends on your specific needs and the size of your business. Cash accounting is great for small businesses that have simple transactions and don’t need to track everything in detail. Accrual accounting, on the other hand, is required for larger businesses and for financial reporting purposes, as it provides a more comprehensive picture of your financial health.

How do companies handle Uncollectible Accounts?

So, how does this direct write-off method work in practice? Let’s say you’re a small business selling clothes online. You might have a customer who orders a few items, but they never pay their invoice. After trying to contact them and giving them a reasonable amount of time, you realize the chances of getting paid are slim. That’s when you would use the direct write-off method. You would record the amount of the unpaid invoice as an expense, reducing your profits for that period. This method is simple, especially for smaller companies that might not have many bad debts.

But remember, the direct write-off method only reflects the bad debt expense in the period it’s written off. It doesn’t show the potential for bad debts throughout the year. This can be a disadvantage for businesses looking to get a clearer picture of their financial health. That’s where another method, the allowance method, comes in handy. The allowance method helps estimate bad debt losses throughout the year, providing a more accurate financial snapshot. This is particularly important for larger companies that might have a higher volume of transactions and therefore, a higher potential for bad debts.

How do you estimate Uncollectible Accounts?

The percentage of sales method is pretty straightforward. You take a look at your total sales for a period and multiply that by a percentage. This percentage is based on your past experience with uncollectible accounts or industry averages. It’s a good starting point, but it doesn’t always paint the whole picture.

The accounts receivable aging method is a bit more granular. This approach categorizes your outstanding receivables based on how long they’ve been outstanding. The longer the amount is overdue, the less likely you are to collect it. You assign different percentages to different age groups based on historical data. This method is considered more accurate because it factors in the time factor of payment.

But there’s more! Some companies use specific identification to pinpoint those accounts that are most likely to go uncollected. They’ll examine individual customer accounts and make a judgment call based on their creditworthiness, payment history, and any other relevant information.

Historical evidence is also a valuable tool. By analyzing past uncollectible account data, businesses can gain insight into their historical trends.

Finally, risk assignment takes into account the specific factors that can impact the probability of collecting an account. This involves assigning a risk score to each customer, based on factors like their credit score, industry, and economic conditions. It’s like a financial detective work to anticipate and mitigate potential bad debts.

By carefully considering these different methods and using a combination of them, you can create a more reliable estimate of uncollectible accounts. This allows you to plan for potential losses, set aside the appropriate reserves, and maintain a healthy financial position.

How do you write off uncollectible accounts?

This approach directly removes a specific account receivable from your accounting records the moment you decide it’s unlikely to be collected. It’s a straightforward way to handle bad debts, but it’s important to understand its implications.

Think of it this way: Imagine you’re running a small bakery and a customer owes you $50 for a delicious cake. After multiple attempts to collect, you realize it’s unlikely they’ll pay. The direct write-off method lets you remove that $50 from your accounts receivable, acknowledging the loss.

The direct write-off approach is simple, but it might not always paint the most accurate picture of your financial health. It only records the bad debt expense when it’s actually determined to be uncollectible, which can be inconsistent. For example, you might have several customers who haven’t paid their bills, but you don’t write them off until much later. This can make your financial statements appear more positive than they actually are, which could mislead investors and creditors.

In simpler terms, while the direct write-off method is easy to understand, it might not give you the most complete and timely view of your business’s financial position.

What percentage of accounts receivable is uncollectible?

This company has $70,000 of accounts receivable that are less than 30 days old and $30,000 that are 30 days or older. That means they could potentially lose $700 from the younger accounts receivable ($70,000 x 1%) and $1,200 from the older accounts receivable ($30,000 x 4%).

In total, the company could be looking at $1,900 in uncollectible accounts receivable. This is just an estimate based on past experience, but it gives the company a good idea of the potential risk involved.

Let’s delve a bit deeper into the topic of uncollectible accounts receivable. This is a critical aspect of financial management and understanding it can significantly impact a company’s bottom line.

Uncollectible accounts receivable, also known as bad debt, represent the portion of accounts receivable that a company expects to never collect. This happens when a customer fails to pay their invoices, despite all efforts by the company to collect the money. The amount of uncollectible accounts can vary based on a number of factors, including:

Industry: Some industries have a higher risk of bad debt than others, for instance, industries dealing with consumer goods often face higher risks compared to industries selling services.

Economic conditions: During recessions or economic downturns, companies may experience a higher rate of bad debt as customers struggle to make payments.

Company’s credit policy: A company’s policies on extending credit to customers can significantly impact bad debt. Stricter credit policies generally lead to lower bad debt levels.

Collection efforts: Efficient and timely collection efforts can significantly reduce the risk of bad debt by minimizing the amount of time outstanding invoices remain unpaid.

It’s important to remember that bad debt is an unavoidable part of doing business for most companies. By understanding the factors that contribute to bad debt, companies can better predict and manage the risk.

One common method for managing bad debt risk is the allowance method. This method involves setting aside an estimate of bad debt expense each period, based on the company’s historical experience and current economic conditions. This allows companies to recognize the potential loss in the same period as the corresponding revenue, improving the accuracy of financial reporting.

Managing bad debt effectively is essential for maintaining a healthy cash flow and ensuring the financial stability of a company. It requires a proactive approach, including establishing sound credit policies, effectively managing customer relationships, and implementing efficient collection processes.

See more new information: linksofstrathaven.com

Two Methods Of Accounting For Uncollectible Accounts: Allowance Vs. Direct Write-Off

Hey there! So, you’re probably wondering how to deal with those pesky uncollectible accounts, right? You know, those accounts that just seem to be stuck in limbo, never getting paid.

It’s a common headache for businesses. We all want to get paid, but sometimes, we just can’t.

The good news is there are ways to account for these bad debts. Today, we’re going to dive into two main methods for accounting for uncollectible accounts: the direct write-off method and the allowance method.

The Direct Write-Off Method

Let’s start with the direct write-off method, which is the simpler of the two. Think of it like this: You’re only going to write off an account when it’s *absolutely certain* it won’t be paid.

Here’s how it works in a nutshell:

1. Identify the Uncollectible Account: When you determine that a specific customer’s account is uncollectible, you’ll make a journal entry to write it off.

2. Journal Entry: You’ll debit Bad Debt Expense and credit Accounts Receivable. This removes the uncollectible amount from your accounts receivable balance.

So, you’re basically saying, “Okay, we’re done with this account. It’s bad debt, and we’re writing it off.”

Example:

Let’s say your company has a $500 account from a customer that’s gone bankrupt. You’ve tried everything to collect, but it’s not happening. You’ll make a journal entry:

* Debit Bad Debt Expense $500

* Credit Accounts Receivable $500

Advantages and Disadvantages of the Direct Write-Off Method

Advantages:

Simple: It’s pretty straightforward. You only recognize the bad debt expense when you’re sure you won’t collect it.

Easy to Track: Keeping track of individual bad debts is easy. You have a clear record of each written-off account.

Disadvantages:

Misleading Financial Statements: The direct write-off method doesn’t match expenses with revenues. This means that your financial statements might not be a true reflection of your company’s performance.

Tax Implications: The IRS might not allow you to deduct the full amount of bad debt expense if you use this method.

The Allowance Method

The allowance method is the more widely accepted and used method for accounting for uncollectible accounts. It’s based on the idea that some bad debts are *expected* as part of doing business.

This method is more sophisticated, but it offers a more accurate picture of your financial health.

Here’s the general idea:

1. Estimate Uncollectible Accounts: You’ll estimate the amount of uncollectible accounts you’re likely to have. This estimate is usually based on historical data, industry trends, and your own judgment.

2. Create an Allowance Account: You’ll create an allowance for doubtful accounts, which is a contra asset account. This account acts as a reduction to your accounts receivable balance. Think of it as a “buffer” for potential bad debts.

3. Adjust the Allowance: At the end of each accounting period, you’ll adjust the allowance account to match your estimated amount of uncollectible accounts.

Example:

Let’s say you estimate that 2% of your accounts receivable will be uncollectible. If your total accounts receivable is $100,000, your allowance for doubtful accounts will be $2,000 (2% of $100,000).

You’ll make a journal entry:

* Debit Bad Debt Expense $2,000

* Credit Allowance for Doubtful Accounts $2,000

Important Note: When you write off a specific uncollectible account using the allowance method, you’ll debit Allowance for Doubtful Accounts and credit Accounts Receivable. This decreases the allowance account and reduces your accounts receivable balance.

Types of Allowance Methods

The allowance method has two main approaches:

Percentage of Sales Method: This method calculates the estimated bad debt expense based on a percentage of your credit sales.

Percentage of Receivables Method: This method calculates the estimated bad debt expense based on a percentage of your accounts receivable.

Advantages and Disadvantages of the Allowance Method

Advantages:

More Realistic Financial Statements: The allowance method provides a more accurate picture of your financial health by matching expenses with revenues.

Better Tax Treatment: You’re more likely to deduct the full amount of bad debt expense for tax purposes.

Disadvantages:

More Complex: Estimating the amount of uncollectible accounts requires more judgment and effort.

Potential for Inaccuracies: Estimating bad debt expense can be subjective, leading to potential errors in your financial statements.

Comparing the Direct Write-Off Method and the Allowance Method

Here’s a quick comparison table to summarize the key differences:

| Feature | Direct Write-Off Method | Allowance Method |

|——————-|———————-|——————–|

| Recognition Timing | When uncollectible | At the end of each period |

| Financial Statements | Misleading | More realistic |

| Tax Treatment | Limited | More favorable |

| Complexity | Simple | More complex |

| Accuracy | Less accurate | More accurate |

Which Method is Right for You?

Ultimately, the best method for accounting for uncollectible accounts depends on your specific circumstances.

* If you’re a small business with a low volume of credit sales and you don’t need to worry about tax implications, the direct write-off method might be sufficient.

* However, if you’re a larger business with a significant amount of credit sales and you want to present accurate financial statements, the allowance method is generally the better choice.

FAQs

1. Can I switch between the direct write-off method and the allowance method?

You can switch between methods, but you need to do it at the beginning of a new accounting period. You also need to make sure that the switch is consistent with GAAP (Generally Accepted Accounting Principles).

2. How do I estimate the amount of uncollectible accounts?

There are a few ways to estimate uncollectible accounts. You can use historical data, industry trends, aging schedules, or other methods.

3. What happens when I write off an account?

Writing off an account means that you’re acknowledging that you’re not going to collect the money. This affects your financial statements and tax returns.

4. What is an aging schedule?

An aging schedule is a report that shows how long your accounts receivable have been outstanding. This helps you identify accounts that are more likely to be uncollectible.

5. Do I have to record bad debt expense?

Yes. You need to record bad debt expense whether you use the direct write-off method or the allowance method.

6. What if I collect a debt that I’ve already written off?

If you collect a debt that you’ve already written off, you’ll need to reverse the original write-off and record the collection. This is done by debiting Accounts Receivable and crediting Allowance for Doubtful Accounts (if using the allowance method).

7. What are some tips for reducing bad debt?

Here are a few tips:

Credit Screening: Be careful about who you extend credit to. Use credit reports and other tools to assess potential customers.

Clear Payment Terms: Make sure your payment terms are clear and easy to understand.

Follow Up Promptly: Follow up with customers who are late with their payments.

Offer Incentives: Consider offering incentives for early payments, such as discounts.

Debt Collection Agency: If necessary, you can use a debt collection agency to collect outstanding debts.

Remember: Managing uncollectible accounts is an important part of running a successful business. By understanding the different accounting methods and taking steps to minimize bad debts, you can improve your cash flow and profitability.

I hope this article has given you a clear understanding of the two main methods for accounting for uncollectible accounts. If you have any more questions, feel free to ask!

7.2 Accounting for Uncollectible Accounts – Financial

Learn how to record bad debt expense and net receivables using two separate accounts: accounts receivable and allowance for doubtful accounts. See examples, journal entries, and financial statements for Open Textbook Library

10.3: Direct Write-Off and Allowance Methods

Companies use two methods for handling uncollectible accounts. The direct write-off method recognizes bad accounts as an expense at the point when judged to be uncollectible and is the required method for federal income Business LibreTexts

9.2 Account for Uncollectible Accounts Using the

The balance sheet method (also known as the percentage of accounts receivable method) estimates bad debt expenses based on the balance in accounts receivable. The method OpenStax

5.3 Understand the methods used to account for uncollectible …

Learn the two methods of accounting for uncollectible accounts: direct write-off and allowance. Compare their advantages and disadvantages, and how they comply with PressbooksOER

Accounting For Uncollectible Receivables

Learn the direct write-off method and the allowance methods for accounting for uncollectible accounts. The direct write-off method is simple but not acceptable for material bad principlesofaccounting.com

Introduction to Uncollectible Accounts | Financial Accounting

Learn how to account for uncollectible accounts, which are trade receivables that are not paid or are unlikely to be paid. Compare the direct write-off method and the allowance Lumen Learning

9.2: Account for Uncollectible Accounts Using the Balance Sheet

When future collection of receivables cannot be reasonably assumed, recognizing this potential nonpayment is required. There are two methods a company may use to Business LibreTexts

Allowance for Doubtful Accounts: Methods of Accounting

Learn how to estimate and record the allowance for doubtful accounts, a contra account that nets against the total receivables to reflect only the amounts expected to be paid. The web page explains the Investopedia

Direct Write-Off and Allowance Methods | Financial Accounting

Companies use two methods for handling uncollectible accounts. The direct write-off method recognizes bad accounts as an expense at the point when judged to be Lumen Learning

LO 9.2 Account for Uncollectible Accounts Using the Balance

There are two methods a company may use to recognize bad debt: the direct write-off method and the allowance method. Bad Debt Expenses. Uncollectible customer South Puget Sound Community College

Allowance Method For Uncollectible Accounts | Principles Of Accounting

Accounts Receivable And Uncollectible Accounts

Accounting For Bad Debts (Journal Entries) – Direct Write-Off Vs. Allowance

Accounting For Receivables : Direct Write Off Method Vs Allowance Method

Allowance For Doubtful Accounts Explained With Examples

Allowance For Doubtful Accounts – Accounts Receivable

Fa25 – How Do You Write Off A Receivable?

Link to this article: two methods of accounting for uncollectible accounts are the.

See more articles in the same category here: https://linksofstrathaven.com/how