How does child care subsidy work in Australia?

The CCS is generally paid directly to childcare providers. The providers then reduce the fees that families have to pay. Families still have a small amount to pay, called the “gap fee.” This helps ensure that families contribute to the cost of their child’s care.

You can pay your gap fee electronically, making it easy and convenient. The childcare provider is also responsible for reporting fee information to the government. This helps ensure that the CCS is being used correctly and that families are receiving the right amount of support.

The CCS is a great way for families to access quality childcare at an affordable price.

Here’s how CCS works in more detail:

1. Families apply for the CCS through the MyGov website. This involves providing details about their income and the child’s age.

2. The government assesses the family’s eligibility and determines the amount of CCS they’ll receive. This amount will depend on factors such as family income, the number of children, and the hours of care needed.

3. The government pays the CCS directly to the childcare provider. This is done on a fortnightly basis, and the provider will then reduce the fees that the family has to pay.

4. Families pay the gap fee. This is the difference between the full cost of childcare and the CCS payment. Families can pay the gap fee electronically, which is often the easiest way to do so.

5. Providers report fee information to the government. This is done to ensure that the CCS is being used correctly and that families are receiving the right amount of support.

The CCS is a valuable program that helps families access quality childcare at a reasonable cost. It’s a great example of how the government is working to support families and children in Australia.

Can I get child care subsidy if I don’t work in Australia?

Education and Training

Volunteer Work

Let’s break down these activities in more detail.

Education and Training

This includes any type of formal study, such as:

University or TAFE courses

Vocational training

Online learning

Language classes

The goal is for you to gain new skills or knowledge that will help you find work in the future.

Volunteer Work

You can also qualify for the Child Care Subsidy if you’re actively volunteering in your community. This could include things like:

Helping at a local charity

Working with children or elderly people

Participating in environmental projects

The key is that your volunteer work should be regular and meaningful. It shouldn’t just be a one-off activity.

It’s important to note that the Child Care Subsidy is means-tested, which means the amount you receive will depend on your income and family situation. If you’re unsure if you qualify for the Child Care Subsidy, it’s best to contact Centrelink for more information. They can help you understand the eligibility criteria and how to apply for the subsidy.

How much do child carers get paid aus?

These figures are just averages, though. The actual salary of a child care worker depends on several factors, such as experience, location, qualifications, and the type of childcare facility. For example, child care workers in major cities like Sydney and Melbourne tend to earn more than those in regional areas. Those with higher qualifications, such as a diploma or degree in early childhood education, may also earn more. Additionally, child care workers who work in private childcare centers might earn more than those working in government-funded centers.

It’s important to remember that these figures are just a starting point. The actual salary of a child care worker may vary depending on the specific circumstances of their employment. If you’re interested in becoming a child care worker in Australia, it’s a good idea to research the different types of childcare facilities and the salary ranges for each. You can also check job boards and online resources to get a better idea of what salaries are being offered in your area.

What age does CCS stop in Australia?

However, there are some exceptions to this rule. For example, if your child has a disability that prevents them from attending secondary school, you may still be eligible for CCS.

To be eligible for CCS, you must also:

* Use an approved child care service. This means that the service must be registered with the Australian government.

* Be responsible for paying the child care fees. The government will then contribute a portion of these fees, depending on your income and the age of your child.

The CCS program is designed to help Australian families with the costs of childcare. The program is a key part of the Australian government’s commitment to providing affordable and accessible childcare for all families.

How Childcare Subsidy works

The CCS program operates on a sliding scale, meaning the amount of subsidy you receive is based on your family income. Essentially, the lower your income, the higher the subsidy amount will be.

Here’s how it works:

* You will need to apply for CCS through the MyGov website or through your child care provider. You will need to provide information about your income and your child’s details.

* Once you are approved, the CCS will be paid directly to your childcare provider.

* You will only need to pay the gap payment, which is the difference between the total cost of childcare and the CCS amount.

It’s important to note that there are income thresholds that apply to CCS. This means that if your income exceeds a certain amount, you will not be eligible for the subsidy. You can find more information about the income thresholds and other eligibility requirements on the Department of Education, Skills and Employment website.

The CCS program is designed to help families with the cost of childcare, but it’s essential to understand how it works to ensure you are getting the most out of it.

The Department of Education, Skills and Employment website also has a handy CCS calculator which can help you estimate your subsidy amount.

So, if you are looking for help with childcare costs, the CCS program is a great resource. Be sure to check if you are eligible and understand the rules around the program.

Are international students eligible for child care subsidy in Australia?

While most international students are not eligible for the Child Care Subsidy, there are some exceptions. For example, if you are a permanent resident or citizen, you may be eligible even if you’re studying. It’s important to check your eligibility and understand the specific requirements.

The Child Care Subsidy is a government program that helps families pay for childcare. It’s a means-tested program, meaning your eligibility and the amount of subsidy you receive depend on your income and family situation.

The good news is that there are other options for international students seeking childcare in Australia:

Private childcare: This is the most common type of childcare, and you can find centers all over Australia.

Family day care: This is childcare provided in a family home.

Long daycare: This is a type of childcare that’s open for longer hours, which can be helpful if you have a busy schedule.

Early learning centers: These centers focus on early childhood education and development.

To find a childcare provider that meets your needs, you can use the Australian Government’s Child Care Finder website. This website allows you to search for childcare providers in your area and filter your search by factors like age group, type of childcare, and opening hours.

Remember to check the childcare provider’s fees and policies before enrolling your child. Some providers offer discounts for international students, so it’s worth asking about these options.

Can an employer pay for childcare Australia?

This means you can reduce your taxable income and save on tax by having your childcare fees packaged into your salary. This is a fantastic benefit for families with young children, as it can help to offset the high cost of childcare.

Let’s dive deeper into how this works!

Here’s how salary packaging for childcare works:

The employer pays for childcare directly: Your employer pays the childcare provider directly from your pre-tax salary.

Tax savings: Because the childcare costs are paid before tax, you can save on your income tax bill.

Fringe Benefits Tax (FBT) exemption: This childcare benefit is exempt from FBT. This is a huge advantage because it means your employer doesn’t have to pay any extra tax on the benefit they are providing to you.

What are the eligibility requirements for salary packaging childcare?

While this seems like a great option, there are a few important things to remember about salary packaging childcare in Australia:

Location of childcare: The childcare facility must be located on your employer’s business premises.

Employer’s agreement: Your employer needs to agree to the arrangement and offer this benefit.

Limited availability: Not all employers offer this type of benefit, so it’s essential to check with your employer if this is an option for you.

Are there any other ways for employers to help pay for childcare?

While this is a great option, it is only available if the childcare facility is on the employer’s premises. There are other options employers can consider to assist employees with childcare costs:

Employer-funded childcare: The employer can contribute to the cost of childcare at any facility, not just those on-site.

Childcare subsidies: Employers can offer childcare subsidies to their employees to help offset the cost of childcare.

Flexible working arrangements: Employers can offer flexible working arrangements, such as working from home or flexible hours, to make it easier for employees to manage their childcare responsibilities.

It’s worth discussing your options with your employer. They might be able to offer other forms of support, even if salary packaging childcare isn’t an option.

Do carers get a bonus this 2024 in Australia?

This supplement is designed to provide extra financial assistance to carers who are doing a vital job supporting their loved ones. It’s a small way to show appreciation for the hard work and dedication that you put into caring for others.

The Carer Supplement is paid automatically, so you don’t need to apply for it separately. If you’re unsure if you’re eligible, it’s a good idea to check with the Australian government’s website or contact their helpline. They’ll be able to provide you with all the information you need to make sure you receive the supplement you deserve.

Remember, the Carer Supplement is only paid for a limited time, so make sure you take advantage of it if you’re eligible. This extra financial assistance can be a big help in making sure you have the resources you need to continue providing excellent care.

Can you get both carer payment and carer allowance?

However, you might be eligible for Carer Allowance if you’re not eligible for Carer Payment. This could happen if you don’t meet the Carer Payment eligibility criteria, like providing care for at least 20 hours per week. Carer Allowance is available to those providing daily care to someone who scores high enough on the Adult Disability Assessment Tool (ADAT) or a Carer Needs Assessment.

Let’s break down the differences between the two payments a bit more:

Carer Payment is a higher payment designed for people who provide a significant amount of care to someone with a disability or serious medical condition. This payment is meant to help with the financial burden of caring for someone full-time.

Carer Allowance, on the other hand, is a smaller payment meant to help people who provide daily care for someone with a disability. It’s a more flexible payment, as it doesn’t have a strict requirement for the number of hours spent caring.

So, if you’re caring for someone with a disability, it’s worth checking if you’re eligible for either Carer Payment or Carer Allowance. You can apply for both payments, but only one will be awarded. The government will automatically assess your eligibility for both and decide which payment is best for your situation.

See more here: Can I Get Child Care Subsidy If I Don’T Work In Australia? | Does Centrelink Back Pay Child Care Subsidy

How do I do my business with Centrelink?

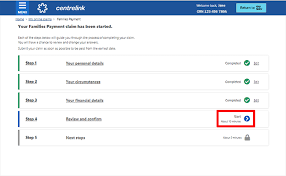

Before you can claim a payment or service, you’ll need to verify your identity. This is a simple process, and we’ll guide you through it. Once you’re verified, you can start claiming the payments and services you’re eligible for.

For certain payments, like Child Care Subsidy (CCS), we’ll need some additional documents to support your claim. This is just to ensure that you receive the correct amount of support.

To access CCS, you’ll also need to confirm your child’s enrollment in childcare. This can be done easily through your myGov account.

Making it Easy to Do Business with Centrelink

Here’s how to get started with your myGov account and Centrelink:

Creating your myGov account: This is your gateway to managing your Centrelink services. You can create a myGov account online at [link to myGov website] or through the myGov app. You’ll need a valid email address and a mobile number to get started.

Linking your myGov account to Centrelink: Once your myGov account is set up, linking it to Centrelink is quick and easy. You can do this online by following the instructions on your myGov dashboard.

Verifying your identity: You’ll need to provide some information to verify your identity, such as your driver’s license, passport, or Medicare card. This is a necessary security measure to ensure you’re who you say you are.

Claiming a payment or service: Once you’ve verified your identity, you can start claiming the payments and services you’re eligible for. You can do this online through your myGov account.

Providing documents for your claim: For certain payments, you might need to provide additional documents to support your claim, such as proof of income or child care enrolment. Don’t worry, you’ll be guided through this process clearly.

Keeping your information up-to-date: Make sure your information is current in your myGov account. This helps ensure that you’re receiving the correct benefits.

myGov and Centrelink are designed to be easy to use. If you have any questions or need assistance, you can call Centrelink’s customer service line or visit a local Centrelink office.

By setting up your myGov account, you can access all of your Centrelink services online, making managing your payments and services a breeze!

Can a child care subsidy claim be backdated?

This means that if you’re experiencing a delay in submitting your claim, you won’t miss out on funding for sessions that happened recently. However, it’s important to remember that Child Care Subsidy won’t be paid for sessions that occurred more than 28 days before your claim was submitted.

Let’s break down what this means:

Imagine your child starts attending care on March 1st, and you finally submit your claim on March 29th. You’ll receive Child Care Subsidy for sessions starting on March 1st (the date they started attending care) up to March 28th. You won’t receive Child Care Subsidy for sessions before March 1st.

On the other hand, if your child starts attending care on March 1st, and you submit your claim on April 2nd, you’ll only receiveChild Care Subsidyfor sessions starting on March 5th up to April 1st. You won’t receive Child Care Subsidy for sessions before March 5th.

The 28-day backdating rule ensures that you don’t miss out on funding for recent care sessions while also providing a fair system for all families. It encourages families to submit claims promptly while also offering a safety net for those who might experience a delay.

It’s important to note that Child Care Subsidy rules and regulations can vary depending on your state or region. For more specific details about backdating and other Child Care Subsidy rules, I recommend contacting your local Child Care Subsidy agency or visiting their website.

What is the child care subsidy (CCS)?

Think of CCS like a government discount on your childcare fees. It’s designed to make childcare more affordable for families, helping them to manage the costs associated with raising children. The amount of CCS you receive depends on a few factors, including your family’s income, the age of your child, and the type of childcare you use.

Here’s a closer look at how CCS works:

Eligibility: To be eligible for CCS, you must meet specific criteria, such as being an Australian resident, having a child under 13 years old who is attending approved childcare, and meeting the income requirements.

Calculating your CCS: The amount of CCS you receive is calculated based on your family income, the hours your child attends childcare, and the type of childcare you choose. There’s a helpful online tool called the Child Care Subsidy Estimator that you can use to get a preliminary estimate of your CCS.

Payment:CCS is paid directly to your childcare provider, so you only pay the remaining portion of your fees. This makes budgeting for childcare easier, as you know exactly how much you’ll need to pay each week or month.

Accessing CCS: To access CCS, you’ll need to create an account on the MyGov website. Once you’ve created an account, you can apply for CCS, and submit any required documents. The entire application process is relatively straightforward and can be done online.

In addition to making childcare more affordable, CCS provides several other benefits:

Supports workforce participation: CCS encourages parents, especially mothers, to return to work or pursue further education knowing that their childcare costs are partially covered.

Improves access to quality childcare: By making childcare more affordable, CCS helps ensure that children from diverse backgrounds have access to high-quality early learning experiences.

Boosts the childcare sector:CCS helps to support the childcare sector by providing a steady stream of income for providers. This allows them to invest in their facilities, staff, and resources, ensuring that they can continue to deliver quality care.

The CCS is a vital program that helps families manage the costs of childcare and ensure their children have access to quality early learning experiences. If you’re considering enrolling your child in childcare, it’s a good idea to research the CCS and see if you’re eligible.

What is Services Australia child care subsidy?

So how do you qualify for this helpful subsidy? You’ll need to meet a few basic requirements. Firstly, you must be an Australian resident. And secondly, your children must be up to date with their immunisations. It’s simple! The government wants to make sure that your children are safe and healthy, and this program helps make quality childcare more accessible.

To ensure you can receive the subsidy, make sure you meet the residency and immunization requirements. Services Australia will assess your eligibility based on your family income and the hours of childcare you need. The more you work or study, the more subsidy you’ll receive! It’s a great way to encourage parents to participate in the workforce or continue their education.

See more new information: linksofstrathaven.com

Does Centrelink Back Pay Child Care Subsidy? What You Need To Know

Let’s talk about child care subsidy and if Centrelink will back pay it. It’s a common question for parents who might have missed out on some of the money they were eligible for. So, let’s break it down!

The short answer? Yes, Centrelink can back pay child care subsidy under certain circumstances.

But, like most things with Centrelink, it’s not quite as simple as just asking for it. There are some rules and requirements you’ll need to be aware of.

When Can You Get Child Care Subsidy Back Pay?

You can usually get back pay for child care subsidy if:

You were eligible for the subsidy, but didn’t receive it for a period of time. This might be because you didn’t apply, there was a delay in processing your application, or you were unaware that you were eligible.

Your circumstances changed and you became eligible for a higher amount of subsidy but didn’t update your details. Maybe you started a new job or had a change in your income.

You were wrongly assessed for the subsidy. This might happen if Centrelink made an error in their calculations or if they didn’t take all of your circumstances into account.

How To Get Child Care Subsidy Back Pay

Now, let’s look at the steps you need to take to get your child care subsidy back pay:

1. Contact Centrelink. This is the first step. You can do this by phone, online, or in person. Explain your situation and ask if you’re eligible for back pay.

2. Gather your supporting documents. Centrelink might ask for proof of your eligibility. Things like your income details, your partner’s income details, your child’s birth certificate, and your child care invoices will come in handy.

3. Complete a back pay claim form. Centrelink will provide you with a form to fill out. Be sure to include all the necessary information and attach any supporting documentation.

4. Submit your claim to Centrelink. Once you’ve filled out the form and gathered your documents, you can submit your claim to Centrelink.

5. Wait for a decision. Centrelink will review your claim and let you know their decision. It might take a few weeks for them to process your claim. So, be patient!

What If My Claim Is Rejected?

If Centrelink rejects your claim, you have the right to appeal their decision. You’ll need to provide more information or evidence to support your claim. There are specific processes for appealing decisions, so it’s important to familiarize yourself with those steps.

How Long Can You Claim Back Pay For?

It’s worth noting that there’s a time limit for claiming child care subsidy back pay. You usually have four years from the date the child care subsidy was due to claim back pay. So, don’t wait too long!

Some Tips

Here are some tips to help make the process smoother:

Keep detailed records. Always keep your income details, child care invoices, and any other relevant documents in an organized way. This will be helpful if you need to provide information to Centrelink.

Be prepared to wait. Centrelink can be a bit slow, so be patient and persistent. It’s a good idea to follow up with them regularly to check the status of your claim.

Don’t be afraid to ask for help. If you’re struggling to understand the process or gather the necessary information, don’t hesitate to ask for help from a Centrelink officer or a financial advisor.

The Importance Of Staying On Top Of Your Child Care Subsidy

Getting your child care subsidy back pay can be a bit of a process, but it’s worth it if you’re eligible. It’s a good idea to stay on top of your eligibility and keep your Centrelink details up to date. That way, you’re less likely to miss out on any child care subsidy you’re entitled to.

FAQs

Q: What if I have already claimed the child care subsidy and am only now realizing I was eligible for more?

A: You can still apply for back pay! It’s always worth checking with Centrelink.

Q: Can I claim back pay if I’m not eligible for the child care subsidy anymore?

A: Unfortunately, you cannot claim back pay if you’re no longer eligible for the child care subsidy.

Q: If Centrelink rejects my claim for back pay, what can I do?

A: You have the right to appeal their decision. Gather any additional evidence or information you may have and contact Centrelink to discuss the appeal process.

Q: How do I find out if I’m eligible for the child care subsidy?

A: The best way to find out if you’re eligible is to check the Centrelink website or speak to a Centrelink officer. They’ll be able to assess your situation and tell you if you qualify.

Q: How can I keep track of my child care subsidy payments?

A: Centrelink will send you a statement every month or so showing how much child care subsidy you’ve received. You can also access your payment history through the Centrelink website.

Q: What if I’ve been underpaid child care subsidy for years?

A: Even if it’s been years, you can still claim back pay for the child care subsidy. The time limit is four years from the date the child care subsidy was due.

Q: Can I get back pay if I didn’t know I was eligible?

A: Yes, you can still get back pay for the child care subsidy even if you didn’t know you were eligible. As long as you meet the eligibility criteria, Centrelink will consider your claim.

Don’t hesitate to contact Centrelink if you have any questions about your child care subsidy eligibility or back pay. It’s best to address any concerns early on. Remember, it’s your right to get the benefits you’re entitled to!

How to claim Child Care Subsidy – Services Australia

Child Care Subsidy – guide to claim. We’ll guide you through the claim process for new claims. We’ll also help you update an existing claim to add another child. A Child Care Subsidy claim can be backdated up to 28 days. Keep in mind, you can’t make a lump Services Australia

How to manage your Child Care Subsidy – Services Australia

If your Centrelink online account is linked to myGov, sign in now to manage your Child Care Subsidy details. Sign in to myGov. If you’re eligible for Child Care Subsidy, you Services Australia

Your income can affect Child Care Subsidy – Services Australia

We compare this information to make sure we’ve subsidised your child care fees correctly in the financial year. If you underestimated your family income, you may end up with an Services Australia

When is CCS BackPaid to Parent – SmartCentral

If a child is enrolled and starts attending care before a claim is made, and the claim is delayed, Child Care Subsidy will not be paid for sessions of care that took smartcentral.net

Child Care Subsidy | myGov

Services Australia pays the subsidy to your child care provider to reduce the fees you pay. Who can get it. To get Child Care Subsidy you must: care for a child myGov

Child Care Subsidy – Department of Education

The Child Care Subsidy (CCS) is the main way the Australian Government helps families with child care fees. CCS is generally paid to providers who pass it on to families as a Department of Education

CCS Back payments – How to identify when and how much

Software – specific guidance. Below are some useful links to guidance on how to identify these back payments for users of QikKids and Kidsoft third party software: • QikKids – Australian Childcare Alliance

Childcare subsidies are increasing — Here’s what you need to know

The subsidy is directly paid to the childcare provider in order to reduce the fees caregivers pay. In order to apply you need a MyGov account which is linked to ABC

Online Claim Help – myGov

Paying child care fees. To get Child Care Benefit or Child Care Subsidy you must be legally responsible to pay the child care fees. For example, if you pay for your child care myGov

Payments for primary school children | myGov

Parenting Payment. The main payment while you’re a young child’s main carer. Child Care Subsidy. This is a Services Australia payment that helps with the myGov

Child Care Subsidy

Child Care Subsidy Income Estimate

Family Tax Benefit And Child Care Subsidy

The Childcare Subsidy Explained

Child Care Subsidy Withholding

Watch This Before Applying For Child Care Subsidy In Australia

Major Changes To Childcare Subsidy From Today | 9 News Australia

Link to this article: does centrelink back pay child care subsidy.

See more articles in the same category here: https://linksofstrathaven.com/how